Endress+Hauser highlights growing trends within the process automation industry

Discover the top 10 most viewed blogs of 2022 covering challenges and solutions across all industries May 9, 2023 – […]

With the recent passing of the Inflation Reduction Act on August 7, 2022, Endress Hauser’s Power and Energy industry expert sat down to answer a few questions regarding the effects this act, and its policies, specifically the hydrogen Production Tax Credit, will have on the industry moving forward.

The Inflation Reduction Act (IRA), among other policies and tax reform, is a historic investment in clean energy and technology. The clean technology portion of the bill is an expansion of existing subsidies on energy storage, carbon capture and electric vehicles, but it also establishes new incentives for clean hydrogen in the form of a Production Tax Credit.

PTC’s are not new. According to the Congressional Research Service, the boom in wind turbine production and proliferation of wind farms in the US is attributed to a similar policy introduced in 1992. For every unit produced, the producer receives a tax credit or direct payment for producing that commodity (per kWh, like with wind and now per kg with hydrogen).

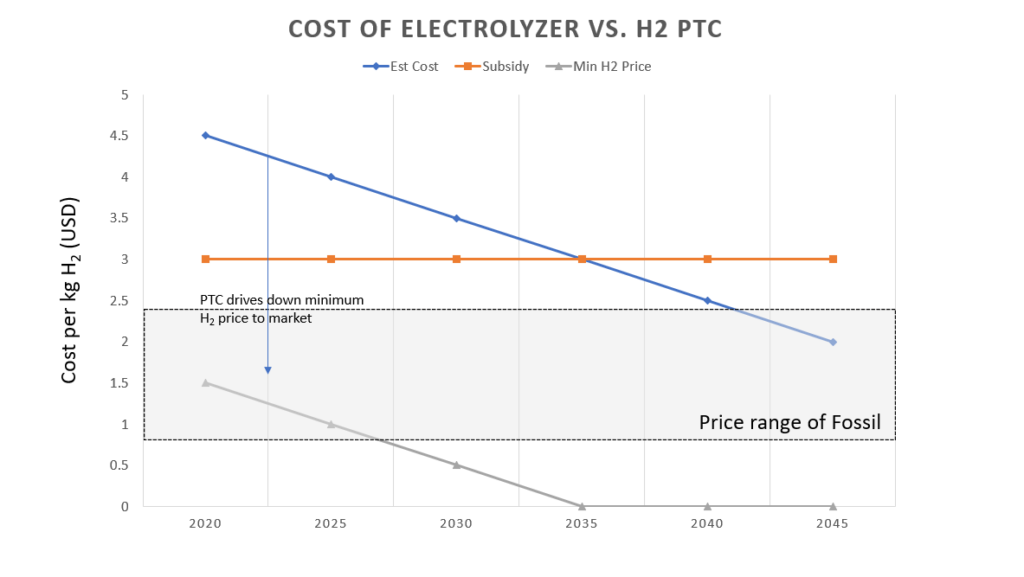

Functionally, this subsidy is designed to lower the market price of hydrogen produced by a sliding scale of lower carbon intensity. In addition to emissions, the production tax credit is highly dependent on the production facilities to “buy American” and pay prevailing wages during the construction of these plants.

| Cost Estimate | PTC or Tax Credit | Net | |

| Electrolyzers | $3.50-6 per kg | $3 per kg | $0.50 – 3 per kg |

| Waste to H2 | $4-6 per kg | $1 per kg | $3-5 per kg |

| SMR w/ CCUS | $2-3.50 per kg | $0.60 or $1 per kg | $1-2.50 per kg |

The hydrogen Production Tax Credit will greatly encourage the production of hydrogen and significantly lower the minimum market price of clean hydrogen. The H2 PTC is a supply side subsidy, encouraging more production of H2, as opposed to a demand side subsidy, encouraging the consumption of clean hydrogen. The difference is subtle, but can have a big impact on the way different markets organize. Hydrogen is a flexible molecule, where there are more theoretical use cases than current demand.

Demand side subsidies would target certain industries, for example, heavily subsidizing Ammonia production facilities to use low carbon hydrogen, and therefore limit the Total Available Market (TAM) of clean hydrogen.

Supply side subsidies are designed to encourage a larger build out of hydrogen production and allow for various industries to decide where clean hydrogen should fit beyond the obvious use case of displacing other hydrogen.

Overtime, the scaling of cleaner hydrogen sources such as electrolyzer plants and the cost optimization around the value chain supporting these facilities, will significantly lower the cost of clean hydrogen in an environment where the market price of hydrogen is still subsidized. This will make large scale hydrogen facilities qualifying for the maximum subsidy very profitable, especially in subsequent years as the costs decrease.

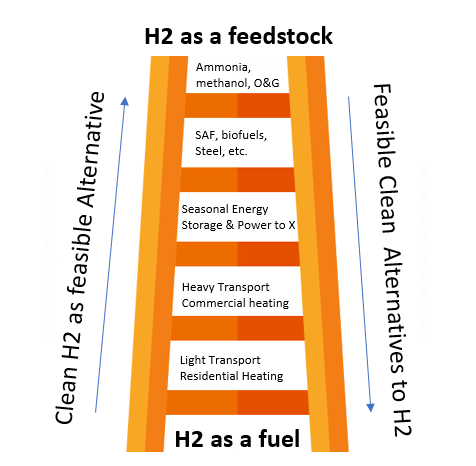

A supply side subsidy that lowers the price of hydrogen to market while not specifying where hydrogen is used, like a demand side subsidy, will increase the use of hydrogen in multiple industry segments. Previously, hydrogen, as a means to decarbonize our industries, has been expressed as a relationship between necessity (no other clean alternatives) vs. competitiveness (other clean alternatives could prevail).

Employing a ladder metaphor, the top rungs are seen as high priority because they are currently using a significant amount of hydrogen that is associated with significant emissions. Swapping in the same molecule, but sourced with lower emissions, is therefore “top of the ladder”. There are other cases, down the ladder, where hydrogen is facing another alternative, most notably in transportation, where there are already good alternatives, like Battery Electric Vehicles (BEVs) (International Energy Agency).

The important takeaway from the diagram to the left is how the ladder prioritizes hydrogen as a catalyst vs. hydrogen as a fuel. As profitability increases on large scale hydrogen plants, there could be an increase in hydrogen being used as a gaseous fuel, for example, to decarbonize gas turbines, an application where our technology is deployed very actively.

Endress+Hauser has significant experience in traditional hydrogen production as well as early electrolyzer applications across our full portfolio. For the H2 PTC, there may be further scrutiny on mass flow measurements as a means to accurately account for the amount of hydrogen being produced.

Hydrogen is typically gaseous when it is produced. Presently, there are many clean processes ranging from gasification or pyrolysis from biomass or waste, steam methane reforming (with carbon capture) or pyrolysis from natural gas, and various types of electrolyzers (PEM, Alkaline, AEM, Solid Oxide) splitting water into H2 and O2. The different processes have very different pressures, temperatures, and flow rates of the hydrogen as it is produced. Endress+Hauser has the largest portfolio of flowmeters under one brand, allowing for an unbiased analysis of the best measurement principle for the product gas, a critical measurement which will be directly tied to quarterly or annual accounting of the PTC.

Ongoing calibrations and reliability contracts could be considered to ensure the robustness and credibility of the field measurement serving as the proxy for the PTC. For fleet wide monitoring or aggregation of hydrogen production across multiple production facilities, our instruments are IIoT ready to present information from device to dashboard to simplify or automate the accounting exercise.

For more information, please reach out to our Industry Manager- cory.marcon@endress.com

Discover the top 10 most viewed blogs of 2022 covering challenges and solutions across all industries May 9, 2023 – […]

With the help of process measurement solutions from Endress+Hauser, a new Long Ridge Energy (LRE) power plant is successfully showcasing […]

Natural Gas and LNG Industry Marketing Manager When and why did you begin working at Endress+Hauser? I started working at […]